This release is the result of three months of development, implementing those new features, and fixing bugs.

Release Highlights:

If you are upgrading from a previous version, there are no mandatory changes in SQL schemas, configuration, API commands or hooks. However new

mod_invites

uses a new table in databases, see below.

Other contents:

Below is a detailed breakdown of the improvements and enhancements:

Database Serialization

This feature adds new way for migrating data between

database backends

by exporting data from one backend to a file and importing that into different backend (or possibly to same backend but on different machine).

Migrating data using this can be executed by first exporting all data with

export_db

command, changing configuration of ejabberd and switching modules to use new database backend, and then importing previously exported data using

import_db

command.

This mechanism works by calling those new command from ejabberdctl, for exporting data:

-

ejabberdctl export_db <host name> <path to directory where exported files should be placed>

-

ejabberdctl export_db_abort <host name>

-

ejabberdctl export_db_status <host name>

and for importing:

-

ejabberdctl import_db <host name> <path to directory with exported data>

-

ejabberdctl import_db_abort <host name>

-

ejabberdclt import_db_status <host name>

Exporting and importing work in background after starting them from

ejabberdctl

(commands executed by ejabberdctl have time limit for how long they can work, with this setup there should be not issue with export or import getting aborted by that), and current progress of background operation can be tracked by calling corresponding

*_db_status

command. Operation in progress can be also aborted by executing

*_db_abort

command.

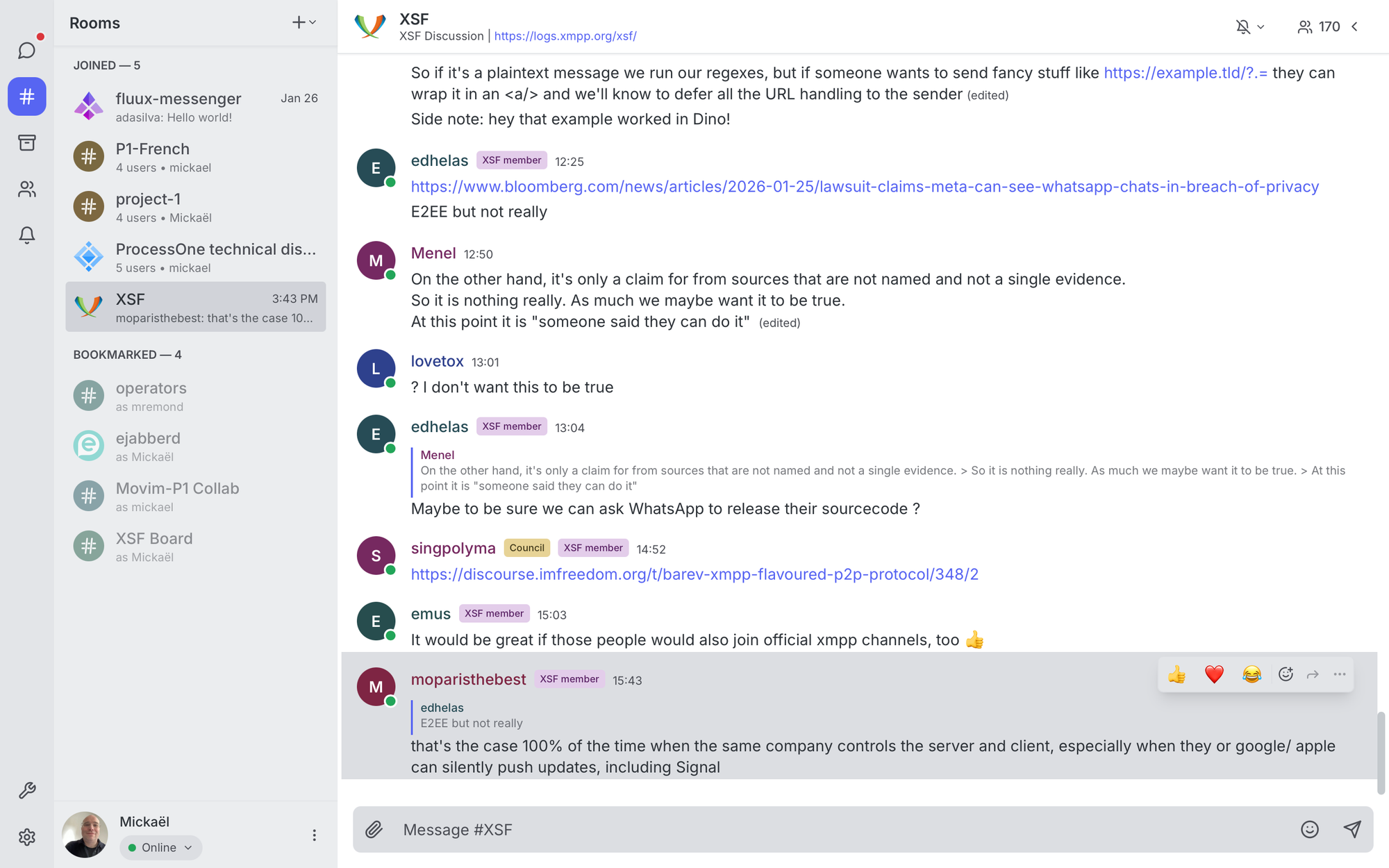

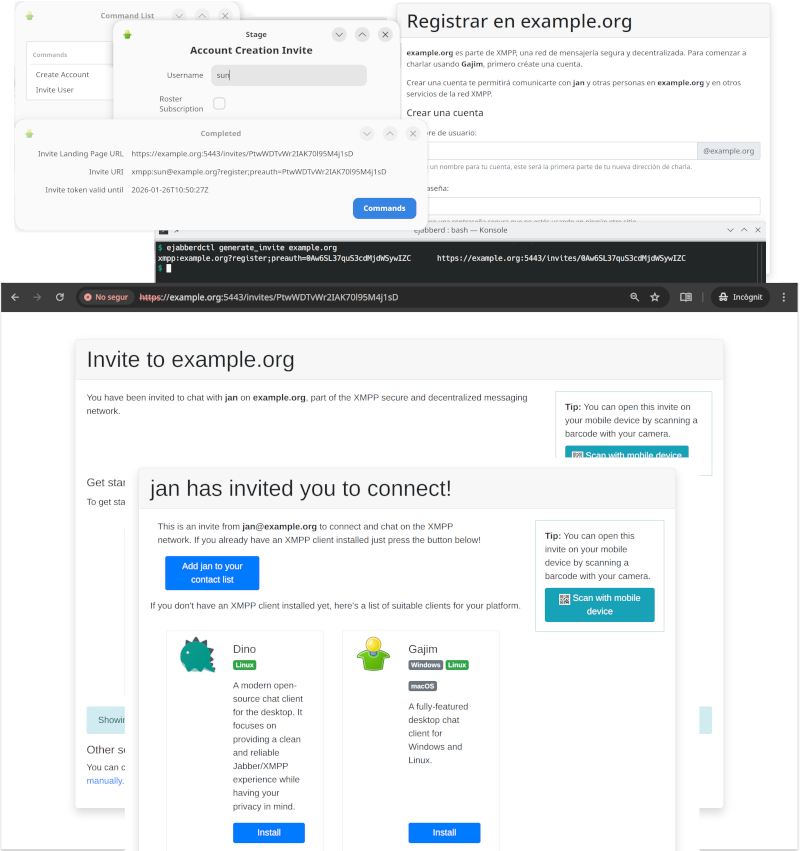

Roster Invites and Invite-based Account Registration

Until now the canonical method to register an account in ejabberd was to let anybody register accounts using In-Band Registration (IBR) (

mod_register

) or Web Registration (

mod_register_web

), and then try to limit abuse with access limitations or

CAPTCHAs

. Often this process got abused, with the result that account registration had to be disabled and rely on manual registration by administrators.

The new

mod_invites

implements support for invite-based account registration: administrators can generate invitation URLs, and send them to the desired users (by email or whatever). Then the user that receives an invitation can visit this invitation URL to register a new account.

On top of that,

mod_invites

lets you create Roster Invites: you can send a link to some other person so they can connect to you in a very user-friendly and intuitive way that doesn&apost require any further interaction. If account creation is allowed, these links will also allow to setup an account in case the recipient doesn&apost have one yet.

Relevant links:

Quick setup:

-

If using SQL storage for the modules and have disabled the

update_sql_schema

toplevel option, then

create manually the SQL table

, see below.

-

If you plan to use the landing page included with

mod_invites

, install JavaScript libraries

jQuery

version

3.7.1

and

Bootstrap

version

4.6.2

. This example configuration will assume they are installed in

/usr/share/javascript

. The

ejabberd

container image already includes those libraries. Some quick examples, in case you need some help:

-

Debian and related:

apt install libjs-jquery libjs-bootstrap4

-

AlpineLinux and other operating systems where you can install

npm

, for example:

apk -U add --no-cache nodejs npm ca-certificates

npm init -y \

&& npm install --silent jquery@3.7.1 bootstrap@4.6.2

mkdir -p /usr/share/javascript/jquery

mkdir -p /usr/share/javascript/bootstrap4/{css,js}

cp node_modules/jquery/dist/jquery.min.js /usr/share/javascript/jquery/

cp node_modules/bootstrap/dist/css/bootstrap.min.css /usr/share/javascript/bootstrap4/css/

cp node_modules/bootstrap/dist/js/bootstrap.min.js /usr/share/javascript/bootstrap4/js/

-

Generic method using the included script:

tools/dl_invites_page_deps.sh /usr/share/javascript

-

Configure ejabberd to serve the JavaScript libraries in path

/share

; serve mod_invites in any path of your selection; and enable mod_invites with some basic options. Remember to setup mod_register to allow registering accounts using mod_invites. For example:

listen:

- port: 5443

ip: "::"

module: ejabberd_http

tls: true

request_handlers:

/invites: mod_invites

/share: mod_http_fileserver

modules:

mod_http_fileserver:

docroot:

/share: /usr/share/javascript

mod_invites:

access_create_account: configure

landing_page: auto

mod_register:

allow_modules:

- mod_invites

-

There are many ways to generate invitations:

-

Login with an admin account, then you can execute Ad-Hoc Commands like "Invite User" and "Create Account"

-

If

mod_adhoc_api

is enabled, you can execute equivalent API Commands

generate_invite

and

generate_invite_with_username

-

Run those API Commands from the command-line, for example:

ejabberdctl generate_invite localhost

-

All those methods give you an invitation URL that you can send it to the desired user, and looks like

https://localhost:5443/invites/Yrw5nuC1Kpxy9ymbRzmVGzWQ

-

The destination user (or yourself) can visit that invitation URL and follow the instructions to register the account and download a compatible client.

If the user has installed already a compatible XMPP client, you don&apost no need to install JavaScript libraries and setup a landing page. In that case, when generating an invitation you will get only the XMPP URI; when the user opens that URI in a web browser, it will automatically open the XMPP client and the corresponding registration window.

Probably you don&apost want to expose the port directly, then you need to setup Nginx or Apache to act as a "reverse" proxy and change your

landing_page

parameter accordingly, for example just

https://@HOST@/invites/{{ invite.token }}

Notice that the landing page can be fully translated using the existing

ejabberd localization feature

.

SQL table for mod_invites

There is a new table

invite_token

in SQL schemas, used by the new

mod_invites

. If you want to use this module, there are two methods to update the SQL schema of your existing database:

If using MySQL or PosgreSQL, you can enable the option

update_sql_schema

and ejabberd will take care to update the SQL schema when needed: add in your ejabberd configuration file the line

update_sql_schema: true

Notice that support for MSSQL in

mod_invites

has not yet been implemented or tested.

If you are using other database, or prefer to update manually the SQL schema:

-

MySQL singlehost schema:

CREATE TABLE invite_token (

token text NOT NULL,

username text NOT NULL,

invitee text NOT NULL DEFAULT (&apos&apos),

created_at timestamp NOT NULL DEFAULT CURRENT_TIMESTAMP,

expires timestamp NOT NULL,

type character(1) NOT NULL,

account_name text NOT NULL,

PRIMARY KEY (token(191))

) ENGINE=InnoDB CHARACTER SET utf8mb4 COLLATE utf8mb4_unicode_ci;

CREATE INDEX i_invite_token_username USING BTREE ON invite_token(username(191));

-

MySQL multihost schema:

CREATE TABLE invite_token (

token text NOT NULL,

username text NOT NULL,

server_host varchar(191) NOT NULL,

invitee text NOT NULL DEFAULT &apos&apos,

created_at timestamp NOT NULL DEFAULT CURRENT_TIMESTAMP,

expires timestamp NOT NULL,

type character(1) NOT NULL,

account_name text NOT NULL,

PRIMARY KEY (token(191)),

) ENGINE=InnoDB CHARACTER SET utf8mb4 COLLATE utf8mb4_unicode_ci;

CREATE INDEX i_invite_token_username USING BTREE ON invite_token(username(191));

-

PostgreSQL singlehost schema:

CREATE TABLE invite_token (

token text NOT NULL,

username text NOT NULL,

invitee text NOT NULL DEFAULT &apos&apos,

created_at timestamp NOT NULL DEFAULT now(),

expires timestamp NOT NULL,

"type" character(1) NOT NULL,

account_name text NOT NULL,

PRIMARY KEY (token)

);

CREATE INDEX i_invite_token_username ON invite_token USING btree (username);

-

PostgreSQL multihost schema:

CREATE TABLE invite_token (

token text NOT NULL,

username text NOT NULL,

server_host text NOT NULL,

invitee text NOT NULL DEFAULT &apos&apos,

created_at timestamp NOT NULL DEFAULT now(),

expires timestamp NOT NULL,

"type" character(1) NOT NULL,

account_name text NOT NULL,

PRIMARY KEY (token)

);

CREATE INDEX i_invite_token_username_server_host ON invite_token USING btree (username, server_host);

-

SQLite singlehost schema:

CREATE TABLE invite_token (

token text NOT NULL,

username text NOT NULL,

invitee text NOT NULL DEFAULT &apos&apos,

created_at timestamp NOT NULL DEFAULT CURRENT_TIMESTAMP,

expires timestamp NOT NULL,

type character(1) NOT NULL,

account_name text NOT NULL,

PRIMARY KEY (token)

);

CREATE INDEX i_invite_token_username ON invite_token(username);

-

SQLite multihost schema:

CREATE TABLE invite_token (

token text NOT NULL,

username text NOT NULL,

server_host text NOT NULL,

invitee text NOT NULL DEFAULT &apos&apos,

created_at timestamp NOT NULL DEFAULT CURRENT_TIMESTAMP,

expires timestamp NOT NULL,

type character(1) NOT NULL,

account_name text NOT NULL,

PRIMARY KEY (token)

);

CREATE INDEX i_invite_token_username_server_host ON invite_token(username, server_host);

New replaced_connection_timeout toplevel option

The new

replaced_connection_timeout

toplevel option enables new session to wait for termination of session that it replaces.

This should mitigate problems where old session presences unavailable sometimes were delivered after new session sent it&aposs presence available.

Improved mod_http_fileserver docroot option

mod_http_fileserver

is a module to serve files from the local disk over HTTP, useful if you just want to serve some HTML or binary files that don&apost need PHP, and don&apost need to setup or configure a separate full-blown web server.

Now the

docroot

option may be a map of paths to serve, allowing this module to serve several paths with different directories for different purposes.

For example, let&aposs serve some public content from

/var/service/www

, also shared JavaScript libraries, and for base URL let&aposs serve from

/var/www

:

listen:

-

port: 5280

module: ejabberd_http

request_handlers:

/pub/content: mod_http_fileserver

/share: mod_http_fileserver

/: mod_http_fileserver

modules:

mod_http_fileserver:

docroot:

/pub/content: /var/service/www

/share: /usr/share/javascript

/: /var/www

Notice that ejabberd includes many modules that serve web services, that may be useful to save you from setting up a full-blown web server, see

ejabberd_http

.

Supported XEP versions

ejabberd supports close to 90

XMPP extension protocols (XEPs)

, either directly implemented in ejabberd source code, in the

libraries

that implement many of the internal features, or in other ejabberd modules available in other repositories like

ejabberd-contrib

.

Those XEPs are updated regularly to bring major improvements, minor changes, fixing typos, editorial or cosmetic changes... and this requires a regular review of those XEP updates in the software implementations to keep them up to date, or at least to document what exact version of the protocols are implemented.

In this sense, we have reviewed all the XEP versions that ejabberd and erlang

xmpp

library were not up-to-date, and have identified which ones are already up-to-date in their DOAP files. Now the pages at XMPP.org describe more accurately the supported protocol versions, see

ejabberd at XMPP.org

and

erlang-xmpp at XMPP.org

.

Erlang, Elixir and Container

ejabberd can be compiled with

Erlang/OTP

from 25.0 up to the latest 28.3.1. Regarding

Elixir

support, ejabberd supports from Elixir 1.14.0 up to the latest 1.19.5

Right now ejabberd compiles correctly with Erlang/OTP from

git

development branch and Elixir 1.20.0-RC1, so hopefully compatibility with the upcoming Erlang/OTP 29 and Elixir 1.20 will be easily achievable.

Binary installers

and the

ejabberd

container now include Erlang/OTP 28.3.1 instead of 27.3, and Elixir 1.19.5 instead of 1.18.4.

Speaking of the

container images

, both

ejabberd

and

ecs

bring other minor changes: they expose more

ports

: 5478 UDP (STUN service), 7777 (SOCKS5 file transfer proxy) and 50000-50099 UDP (TURN service).

The container images in their

ejabberd.yml

file use new macros

PORT_TURN_MIN

,

PORT_TURN_MAX

, and

STARTTLS_REQUIRED

that you can setup easily without modifying

ejabberd.yml

, see

macros in environment

.

Improved ERL_DIST_PORT

ejabberd uses

Erlang Distribution

in the

ejabberdctl

shell script and also for building a cluster of ejabberd nodes.

That Erlang Distribution has historically used the

epmd

program to assign listening ports and discover ports of other nodes to connect. The problems of using epmd are that:

-

epmd

must be running all the time in order to resolve name queries

-

epmd

listens in port

4369

-

the ejabberd node listens in a random port number

How to avoid

epmd

since Erlang/OTP 23.1 and ejabberd 22.10 ? Simply set the

ERL_DIST_PORT

environment variable in the

ejabberdctl.cfg

file:

ERL_DIST_PORT=5210

Since now,

ejabberdctl

passes arguments to Erlang to listen for erlang distribution connections in TCP port 5210, and establish erlang distribution connections to remote ports 5210. That way you know exactly, in advance, what port number to open in the firewall or container.

This ejabberd release introduces some small improvements that facilitate using the

ERL_DIST_PORT

environment variable:

-

ejabberdctl

prints an informative message when it detects that there may be a port number collision, which may happen if you start several ejabberd nodes in the same machine listening in the same

ERL_DIST_PORT

and same

INET_DIST_INTERFACE

.

-

When ejabberd is starting, now it prints the address and port number where it listens for erlang distribution:

[info] ejabberd 26.01 is started in the node ejabberd@localhost in 1.90s

[info] Elixir 1.19.4 (compiled with Erlang/OTP 28)

[info] Erlang/OTP 29 [DEVELOPMENT] [erts-16.2] [source] [64-bit] [smp:4:4] [ds:4:4:10] [async-threads:1] [jit:ns]

[info] Start accepting TCP connections at 0.0.0.0:5210 for erlang distribution

[info] Start accepting TCP connections at [::]:5222 for ejabberd_c2s

[info] Start accepting TCP connections at [::]:5269 for ejabberd_s2s_in

...

-

A new

make relivectl

is introduced, which uses

ejabberdctl

script to start ejabberd (not like

make relive

), and starts ejabberd immediately without building a release (not like

make dev

).

-

The ejabberd Documentation site has improved and updated pages about

Security

,

Erlang Distribution

, and

Clustering

.

New make relivectl

make relive

was

introduced in ejabberd 22.05

. It allows to start ejabberd in path

_build/relive/

without installing it, by using

rebar3 shell

and

mix run

. It automatically compiles code at start and

recompiles changed code at runtime

. But it doesn&apost use the

ejabberdctl

script, and doesn&apost read

ejabberdctl.cfg

, this means that depending on what you are testing, it may not be useful and you had to switch to

make dev

.

A new

make

target is now introduced:

make relivectl

. This is similar, as it starts ejabberd without requiring installation, using path

_build/relivectl/

to store the configuration, database and log files. The benefit over

relive

is that

relivectl

uses

ejabberdctl

and reads

ejabberdctl.cfg

. The drawback is that it doesn&apost recompile code automatically. The benefit over

make dev

is that

relivectl

doesn&apost build an OTP release, so it&aposs faster to start.

Let&aposs summarize all the

make

targets related to installation to determine their usage differences:

make ...

|

install

|

install-rel

|

prod

|

dev

|

relivectl

|

relive

|

|

Writes files in path

|

/

|

/

|

_build/

prod/

|

_build/

dev/

|

_build/

relivectl/

|

_build/

relive/

|

|

Installs

|

✅

|

✅

|

manually uncompress

*.tar.gz

|

-

|

-

|

-

|

|

Uninstall with

|

uninstall

⚠️

incomplete

|

uninstall-rel

✅

|

manual remove

|

-

|

-

|

-

|

|

Start tool

|

ejabberdctl

|

ejabberdctl

|

ejabberdctl

|

ejabberdctl

|

ejabberdctl

|

rebar3/mix

|

Reads

ejabberdctl.cfg

|

✅

|

✅

|

✅

|

✅

|

✅

|

❌

|

|

Recompiles

|

-

|

✅

|

✅

|

✅

|

❌

|

✅

|

|

Starts ejabberd

|

-

|

-

|

-

|

-

|

✅

|

✅

|

|

Recompiles at runtime

|

-

|

-

|

-

|

-

|

❌

|

✅

|

|

Execution time (s.)

|

13

|

40

|

57

|

35

|

4

|

9

|

As seen in the table,

make install / uninstall

seem unnecessary nowadays, because

install-rel / uninstall-rel

allow to install and uninstall correctly all the files. Maybe in the future the implementation of

make install / uninstall

could get replaced with

make install-rel / uninstall-rel

...

In the same sense,

make dev

now apparently falls short between

make prod

(which is absolutely indispensable to build a full OTP release) and

make relive/relivectl

(useful, featureful, and fast for development and testing purposes).

WebAdmin Menu Links

Do you remember that

ejabberd 25.07 introduced

a link in WebAdmin to the local Converse.js page in the left menu when the corresponding

mod_conversejs

is enabled?

Technically speaking, until now the WebAdmin menu included a link to the first

request_handler

with

mod_conversejs

that the admin configured in

ejabberd.yml

. That link included the authentication credentials hashed as URI arguments if using HTTPS. Then

process/2

extracted those arguments and passed them as autologin options to Converse.

From now,

mod_conversejs

automatically adds a

request_handler

nested in WebAdmin subpath. The WebAdmin menu links to that converse URI; this allows to access the HTTP auth credentials, no need to explicitly pass them.

process/2

extracts this HTTP auth and passes autologin options to Converse. Now scram password storage is supported too.

In practice, what does all that mean? Just enable the

mod_conversejs

module, and WebAdmin will have a private Converse URL for the admin, linked in the WebAdmin menu, with autologin. No need to setup a public

request_handler

!

For example, let&aposs configure conversejs only for admin usage:

listen:

-

port: 5443

module: ejabberd_http

tls: true

request_handlers:

/admin: ejabberd_web_admin

/ws: ejabberd_http_ws

modules:

mod_conversejs:

conversejs_resources: "/home/conversejs/12.0.0/dist"

Of course, you can setup a public

request_handler

and tell your users to access the corresponding URL:

listen:

-

port: 5443

module: ejabberd_http

tls: true

request_handlers:

/admin: ejabberd_web_admin

/public/web-client: mod_conversejs

/ws: ejabberd_http_ws

modules:

mod_conversejs:

conversejs_resources: "/home/conversejs/12.0.0/dist"

With that configuration, what is

the corresponding URL

?

Login to the WebAdmin and look at the left menu: now it displays links to all the configured HTTP services:

ejabberd_captcha

,

ejabberd_oauth

,

mod_conversejs

,

mod_http_fileserver

,

mod_register_web

. Also

mod_muc_log_http

and

mod_webpresence

from

ejabberd-contrib

show links in the WebAdmin left menu. Additionally, the menu shows a lock if the page is encrypted HTTPS, and an

!

if it is not.

Acknowledgments

We would like to thank the contributions to the source code, documentation, and translation provided for this release by:

And also to all the people contributing in the ejabberd chatroom, issue tracker...

Improvements in ejabberd Business Edition

Customers of the

ejabberd Business Edition

, in addition to all those improvements and bugfixes, also get the following changes:

-

New module

mod_push_gate

that can act as target service for

mod_push

, and which can deliver pushes using configured mod_gcm or mod_applepush instances.

-

New module

mod_push_templates

that can be used to have different push notifications for message class matching configured data patterns.

-

New database conversion routines targeting p1db backends

ChangeLog

This is a more complete list of changes in this ejabberd release:

Compile and Start

-

Remove dependencies, macros and code for Erlang/OTP older than 25

-

Require Elixir 1.14 or higher, that&aposs the lowest we can test automatically

-

ejabberdctl

: Support NetBSD and OpenBSD

su

(

#4320

)

-

ejabberdctl.template

: Show meaningful error when

ERL_DIST_PORT

is in use

-

ejabberd_app

: Print address and port where listens for erlang node connections

-

Makefile.in

: Add

make relivectl

similar to

relive

but using

ejabberdctl

Databases

-

Add db_serialize support in mnesia modules

-

Add db serialization to

mod_muc_sql

-

New database export/import infrastructure

-

Add commands for new database export/import

-

Apply timestamp pass in

?SQL_INSERT

queries

-

Update p1_mysql to bring fix for timestamp decoding

-

Extend timestamp type handling in sql macros

-

Revert changes to conversion of pgsql

int

types

Installer and Container

-

make-binaries

: Bump Erlang/OTP 28.3.1 and Elixir 1.19.5

-

Dockerfile

: Bump Erlang/OTP 28.3.1 and Elixir 1.19.5

-

Dockerfile

: Expose also port 7777 for SOCKS5

-

Dockerfile

: Configure TURN ports and expose 5478 50000-50099

-

Dockerfile

: Try to fix error with recent

freetds

Alpine package

-

Container: Setup new macro

STARTTLS_REQUIRED

to allow easy disabling

MUC

-

Add

muc_online_rooms_count

API command

-

Set

enable_hats

room option

true

by default

-

Allow vcard queries even when IQ queries are disabled (

#4489

)

-

Announce

stable-id

feature from XEP-0045 1.31, supported since long ago

-

Fix

preload_rooms

in case of SQL database (

#4476

)

-

Run new hooks:

registering_nickmuc

and

registered_nickmuc

(

#4478

)

-

When deleting account, unregister account&aposs nicks in all MUC hosts (

#4478

)

-

mod_muc_log

: Crash in

terminate/2

when stopping module (

#4486

)

-

mod_muc_occupantid

: Keep salt per MUC service, not individual rooms

-

mod_muc_room

: Rewrite hats code that gets xdata values

-

mod_muc_room

: Handle hats without definition (

#4503

)

-

mod_muc_room

: When user has no hats, don&apost store in hats_users

WebAdmin

-

ejabberd_http

: Run new

http_request_handlers_init

fold hook

-

ejabberd_http

: Add helper

get_auto_urls/2

that returns all URLs and TLS

-

ejabberd_web_admin

: Add helper functions

make_menu_system

-

ejabberd_web_admin

: Show menu system only when can view vhosts

-

ejabberd_web_admin

: Pass Level in

webadmin_menu_system_post

and

inside

hooks

-

mod_conversejs

: Improve link to conversejs in WebAdmin (

#4495

)

-

When epmd isn&apost running show explanation in Clustering WebAdmin page

-

Use improved WebAdmin menu system in more modules

-

When building WebAdmin menu system,

{URLPATH}

in link text is substituted

Web Services

-

rest

: Use separate

httpc

profile

-

ejabberd_captcha

: Use

mod_host_meta:get_auto_url/2

-

ejabberd_http

: Support repeated module in request_handlers

-

ejabberd_http

: Get back handling when BOSH or WS are disabled

-

mod_host_meta

: Move

get_url

functions from

mod_host_meta

to

ejabberd_http

-

mod_host_meta

: Allow calling

get_url/2

for other modules, not only WebSocket

-

mod_host_meta

: Cosmetic rename Module to Handler

-

mod_http_upload

: New

content_type

option similar to

mod_http_fileserver

(

#4488

)

-

mod_http_upload

: Pass ServerHost, not Host which may be

"upload.HOST"

-

mod_http_upload

: Amend the fix for #4450 to support IDNA correctly (

#3519

)

-

mod_http_fileserver

: Support map of paths in

docroot

option

-

mod_conversejs

: Add new Conversejs Paths and ContentTypes (

#4511

)

-

mod_conversejs

: Use ContentType functions from

mod_http_fileserver

(

#4511

)

-

Use

/websocket

URL in default configuration like

mod_conversejs

, it&aposs more meaningful

Core and Modules

-

Add

replaced_connection_timeout

toplevel option

-

Fix nasty SSL warnings (

#4475

)

-

ejabberd_commands

: Show meaningul error message when problem executing command (

#4506

)

-

ejabberd_logger

: Append "color clean" only in console template, not file

-

ejabberd_oauth

: Log error if

oauth_list_tokens

executed with unsupported DB (

#4506

)

-

misc

: Get back functions and mark them as deprecated

-

mod_adhoc_api

: Show nice command name, as WebAdmin already does

-

mod_pubsub

: Deliver pubsub notifications to remote servers for nodes with presence based delivery

-

mod_scram_update

: Don&apost hard-code iteration count

-

Bump many XEPs versions that are already supported

-

Improve documentation of

install_contrib_modules

(

#4487

)

Full Changelog

https://github.com/processone/ejabberd/compare/25.10...26.01

ejabberd 26.01 download & feedback

As usual, the release is tagged in the Git source code repository on

GitHub

.

The source package and installers are available in

ejabberd Downloads

page. To check the

*.asc

signature files, see

How to verify ProcessOne downloads integrity

.

For convenience, there are alternative download locations like the

ejabberd DEB/RPM Packages Repository

and the

GitHub Release / Tags

.

The

ecs

container image is available in

docker.io/ejabberd/ecs

and

ghcr.io/processone/ecs

. The alternative

ejabberd

container image is available in

ghcr.io/processone/ejabberd

.

If you consider that you&aposve found a bug, please search or fill a bug report on

GitHub Issues

.

chevron_right

chevron_right

ejabberd 26.02

ejabberd 26.02